By Adam Bruno, Author of They Lied: The Real Cost of Your Retirement

As an Author, Business Owner, and Certified Financial Fiduciary®, it has been a very busy 2021 for me. As we approach the end of 2021, I believe it is fair to say that this year has been challenging if you are in retirement. The families we serve at Evolution Wealth Management and Evolution Retirement Services will tell you differently, because they are a bit spoiled! I love spoiling the families we serve.

The Private Wealth Management world allows us to do some pretty unique things for our families. Their entire retirement picture is addressed and taken care of. Whether it is Investment Planning, Income Planning, Estate Planning, Advanced Tax Planning, Medicare Planning, it is all taken care of for them with our team of highly vetted professionals.

Because of this, we have been able to identify an enormous problem retirees are facing today. The problem is BONDS!

If you are reading this, and like so many others in retirement, bonds are usually the first place you look to achieve safety. You have heard the old saying many times in your life. You buy bonds for safety; you buy stocks when you are willing to take risks. The balance between these two investments is usually adjusted to reflect how much risk you are willing to take as an investor.

For example, a more conservative investor potentially has a 30/70 split. Thirty percent (30%) of their investments are in stocks and seventy percent (70%) are in bonds. I don’t need to give you a lesson in Finance 101. If you are reading this, the chances are high that you know the difference between a stock and a bond. Because of this, I would like to spend more time in this article addressing the problem with bonds today.

There is a very good chance that your bonds are either not performing or potentially costing you money. In a year where inflation as I am writing this is hovering at 6.8%, it is very dangerous for you to not realize the problems with the current bond market. No performance from your bonds means that you could have just had that money sitting in your bank account rather than pay the commissions and fees of the bond world. Either way, the result is the same. You are losing 6.8% of your purchasing power on your money.

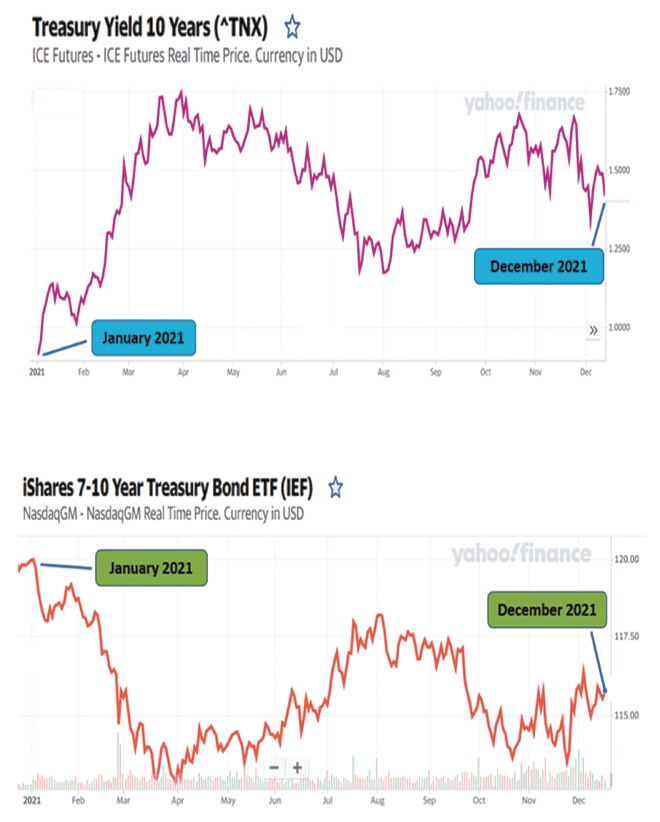

As you can see in the illustration below, interest rates on the 10-year treasury have increased significantly over the last year. It truly is a historical time in the investment world. Because of these increasing rates, take a look at the second illustration below. You will notice that the performance of bonds has dramatically decreased. This is a normal response in a rising interest rate environment, an environment that we haven’t seen many times in history. This response can be devastating to your portfolio, especially when investments that are normally considered “safe” begin drawing negative performance.

You should understand that right now there are options and alternatives to bonds that can still provide you with safety and growth. We help families just like you create their own Bond Alternatives. You probably won’t hear about these alternatives from the traditional big retail brokers and advisors. I want you to take a good hard look at your portfolio. You could say that your portfolio has been up, so you aren’t worried about your bonds. Your portfolio has likely been up because the market has been up.

Do yourself and your loved ones a favor. Separate your bond investments from your stock investments. See what kind of performance you have gotten from your bonds alone. You might be very surprised. If you are, and you want to learn other strategies that successful families just like you are using right now, give us a call.

There is nothing more frustrating than money that is supposed to be safe, not performing or losing money. You have options, and you don’t have to settle for poor bond performance anymore.

If you have questions, please call my office at (239) 771-8696 and schedule your confidential visit with me.

For more information go to taxfreefortmyers.com to see my upcoming webinar schedule or to download a complimentary copy of my book.

Wishing you and your family a Happy New Year! Hug the ones you love and hang on for as long as you can, because we are never guaranteed tomorrow.

Treasury Yield 10 Years https://yhoo.it/321QaYa

iShares 7-10 Year Treasury Bond ETF (IEF) https://yhoo.it/3oYTA73

Investment advisory services are offered through Evolution Wealth Management Inc., an investment advisor registered with the State of Florida. Registration does not imply any level of skill or training. Evolution Wealth Management’s unique CRD number is 307644. You can obtain a copy of Evolution Wealth Management’s firm brochure (Form ADV Part 2A) free of charge by visiting https://adviserinfo.sec.gov/firm/summary/307644. Evolution Wealth Management offers investment advisory services only where it is appropriately registered or exempt from registration and only after clients have entered into an investment advisory agreement confirming the terms of engagement and have been provided a copy of the firm’s ADV Part 2A. Insurance services provided by Evolution Retirement Services. Any guarantees mentioned are backed by the financial strength and claims-paying ability of the issuing insurance company and may be subject to restrictions, limitations, or early withdrawal fees, which vary by the issuer. They do not refer, in any way to securities or investment advisory products. You should consider the charges, risks, expenses, and investment objectives carefully before entering a contract. This material has been prepared for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. This material is not intended to provide, and should not be relied on for tax, legal, accounting, or other financial advice. Evolution Wealth Management and Evolution Retirement Services do not provide tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Evolution Wealth Management and Evolution Retirement Services are affiliated entities.