By Mark E. Ary, MBA – Senior Licensed Loan Originator

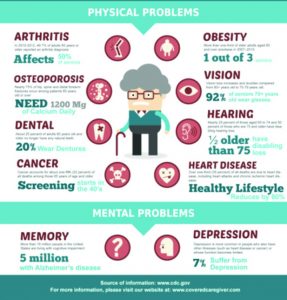

Getting older can bring seniors health challenges. The United States spends over 2.5 times more on health care than most of the world’s other developed nations. The percentage of the U.S. economy spent on health care for individuals ages 65 and older exceeds 5 percent — a proportion that is expected to double by 2030 and triple by 2050.

Getting older can bring seniors health challenges. The United States spends over 2.5 times more on health care than most of the world’s other developed nations. The percentage of the U.S. economy spent on health care for individuals ages 65 and older exceeds 5 percent — a proportion that is expected to double by 2030 and triple by 2050.

People in America today can expect to live longer than ever before. Once you make it to 65, the data suggests that you can live another 19.3 years, on average, according to the Centers for Disease Control and Prevention (CDC). As seniors age, they may struggle to afford soaring health care costs as their income is shrinking— which is unfortunate as there is no end in sight. According to a recent study by the Employee Benefit Research Institute (ERBI), a U.S. couple retiring in 2016 needed approximately $246,000 in order to have a 75 percent chance of covering their future medical costs. Retired couples who want a 90 percent chance of being able to pay for their out-of-pocket medical costs need to have around $306,000. Seniors who don’t have enough in savings or retirement income are often forced to deal with looming medical debt.

Medical debt can be more emotionally stressful than other types of debt because it almost never accrues by choice. Medical debt is most often a product of an unforeseen illness or accident. It can add up quickly and unexpectedly, while simultaneously amplifying the health problems that caused it. This is where a reverse mortgage can be a way to alleviate the stress of dealing with those bills that you’re struggling to afford.

Proceeds from a reverse mortgage can be used for just about anything you want. As noted by AARP, “as rising health care costs continue to be a critical issue for older Americans and their children, a HECM (home equity conversion mortgage) Reverse Mortgage is a great tool to pay for the increasing costs of health care in retirement, which gives seniors a financial safety net for paying for healthcare costs.”

Moreover, many seniors find themselves in situations where their retirement income or savings have fallen behind as the costs of health care necessities continue to rise exponentially. In many cases, if you or someone you love is injured or falls ill, other medical interventions are also needed. While Medicare, Medicaid, and private insurances pay for doctor’s visits, hospitalizations, and some home care, these plans frequently require co-payments, insurance deductibles, prescription drugs, therapy, etc.

Proceeds from a reverse mortgage can be used for just about anything you want. As noted by AARP, “as rising health care costs continue to be a critical issue for older Americans and their children, a HECM (home equity conversion mortgage) Reverse Mortgage is a great tool to pay for the increasing costs of health care in retirement, which gives seniors a financial safety net for paying for healthcare costs.”

Moreover, many seniors find themselves in situations where their retirement income or savings have fallen behind as the costs of health care necessities continue to rise exponentially. In many cases, if you or someone you love is injured or falls ill, other medical interventions are also needed. While Medicare, Medicaid, and private insurances pay for doctor’s visits, hospitalizations, and some home care, these plans frequently require co-payments, insurance deductibles, prescription drugs, therapy, etc.

While the Home Equity Conversion Mortgage (HECM) does have a checkered past, in recent years it has become a very viable option for retirement planning. HUD added many additional guidelines that took effect in April 2015 which put safeguards in place to protect homeowners from losing their homes.

Financial planning expert Danielle Gates, CFP® and owner of D. Gates Wealth Management notes that a reverse mortgage can be a blessing for many seniors and under the right circumstances, “the proceeds from a reverse mortgage are a great way for seniors to pay for various health care costs such as, in-home care, nursing home care and assisted living, or used for other supplemental health care costs while protecting their other assets and income streams.”

Some of the things you might want to use a reverse mortgage for are:

Annual Medicare deductibles, unexpected medical procedures, copays, prescription drugs, existing medical debt, in-home caregiver, long-term health care and insurance, physical therapy, medical supplies, home improvements and/or home modifications for added mobility and easier accessibility.

Reverse mortgages are versatile and can provide a range of financial options that enable you to choose the kind of health or personal care you desire, in the setting you prefer. Because the funds from a reverse mortgage can be taken by the borrower as a lump sum, monthly payment, line of credit, or a combination of these, you have tremendous flexibility when planning how to address your health care needs. That is, you might choose to receive monthly payments to budget for often overlooked needs

such as a cleaning service, grocery delivery, or transportation. Or, you might select a line of credit because that’s the best strategy for you to pay your annual Medicare or private insurance deductibles or HMO co-payments on doctor visits and prescription drugs. No matter what your needs are, a reverse mortgage gives you more choices and a better way to plan your own care with confidence.

A reverse mortgage does not affect regular Social Security or Medicare benefits. However, if you are on Medicaid, any reverse mortgage proceeds that you receive must be used immediately. Funds that you retain would count as an asset and could impact Medicaid eligibility. Regardless, you should contact the local Area Agency on Aging or a Medicaid expert to discuss further.

As noted above, there are many different uses for a reverse mortgage and if paying for your health costs is a concern for you, you might want to reach out to your financial planner sooner rather than later to help determine if a reverse mortgage is right for you.

NMLS # 499320

NAR License # 258006473

FAR License # 3078731

Notary Public

“Experience and Integrity… It Matters”

“What sets me apart from my competition is that my rates and fees are among the best in the nation.” —Mark Ary

Edison Mortgage Group

Cape Coral, FL 33904

(239) 549-1997

(239) 215-8436 E-Fax

Financing@MarkAryMortgages.com