By Ulla-Undine Merritt (Dee) National Producer Number (NPN) 8853366

VERY IMPORTANT: Regarding Medicare it is illegal for an insurance agent to call, text, e-mail, knock on your door, hang anything on your door or vehicle or approach you without your consent. If they do as for their National Producer Number NPN, and you will hear a click and removed from their list. If they don’t hang-up get their number and report them to Medicare. There is so much fraud where people are being switched to plans that they never approved or were miss led. Shop local, do background checks before you give anyone your personal information. You can google them, google reviews, check their Facebook, etc. Make sure that if you are working with someone you can call them personally if you have any questions or concerns.

Medicare Annual Enrollment is October 15-December 7th for January 1st, 2026, effective. What can be changed at this time is Medicare Part D Drug Plans and Medicare Advantage Plans. You should have received your Notification of Change from your current insurance plan. This outlines the current year to the new year changes, as an example if your specialist provider costs $20 now it might say $35 in 2026 (no correlation just an example).

Substantial changes to Medicare Part D “most insurance carriers have taken away insurance agents’ ability to help you with your Part D Only drug plans his does not apply to most Advantage plans”, standalone drug plans as well as Advantage Plans, you won’t have to pay more than $2,100 in out-of-pocket costs, which include deductibles, co-pays, coinsurance. It is especially important to check your plans formulary as medication must be in formulary to be capped. 2026 RX deductible will be capped at $615.00. As a reminder the cost of the plan is not as important as the cost plus your medications, that is what you look at, the total cost. It is important to know what the medication is used for to determine if it is covered by the plan. Example Wycovy may be covered but in order to be covered it must be used for certain heart conditions or diabetes, Medicare does not cover weight loose medications at this time. Many carriers are consolidating Part D plans or eliminating them completely. As a reminder if you choose NOT to ENROLL in a Part D drug plan and in later years you will have to wait for Annual Enrollment and then you will assed a penalty for every month you did not have a drug plan, that penalty will last for the REST OF YOUR LIFE! Careful not choosing a drug plan.

Resource: medicare.gov

Medicare Part C / Advantage Plans, most carriers have raised out of pocket limits and copays along with decreased extra value benefits for 2026. Annually Medicare Advantage Plans make changes. They must include all the same features as Original Medicare but not at the same cost share. They can have a premium, Medical and or Prescription deductible, copays and coinsurance can change. Extra Value such as Vision, Dental, Over the Counter, Part B Give Back, transportation, etc. can all change or be eliminated. Medicare sets the annual in-network out of pocket maximum; in 2025 it is $9,350 for in-network and $14,00 out-of-network services combined. However, individual insurance plans may set lower limits.

The old saying if it is not broken do not fix it DOES NOT apply to Annual Enrollment. Every year I see many people that have not checked/compared their current plan to what is new. I have saved so many people hundreds and in many cases thousands of dollars. You should be working with a broker that represents many insurance companies. Make sure you check them out, especially if you are going to allow someone in your house. I recommend meeting in their office. For myself we represent most insurance carriers in our area and carrying all their literature with me is almost impossible. We use three large screens so that our clients can clearly see and compare the differences between the plans. The minimum information always needed is all your doctors, medications: names, milligrams, and dosage. We load your current plan and then compare it to all the other companies in your area. What companies have all your doctors, the price for your medication normally makes a significant difference. Then the Extra Value what is most important to you. We do NOT CHARGE for our review and if warranted to change your insurance plan. Ethics is most important and if you are on the best plan we will tell you, plus you can see for yourself.

If your plan was CANCELLED/DROPPED for 2026, you have a guaranteed issue into a Medigap/Medicare Supplement. This is huge and very important, know your options!

As a reminder it is illegal for an insurance agent to contact you unless you give them permission. There are specific forms that you should sign, such as a Scope of Appointment which outlines what you want to talk about. This form should be signed at least 48 hours prior to your meeting or if you walk into their office, prior to speaking about Medicare.

Medicare Seminar’s they are good for general information. A one-to-one appointment where you can dive into your doctors and medication is best, plus you can then compare other companies in one place.

When you turn 65 you are eligible for Medicare, once you have worked 40 quarters roughly 10 years there is no cost for Medicare Part “A”. Part A covers Hospitals, Skilled Nursing, Home Health & Hospice. Medicare Part B you can choose to take at 65 or you can hold off if you are still working and have credible coverage. If you do not have group health insurance that is considered qualified, and then you want Medicare you would have a late enrollment penalty for each month you did not have Part B & Part D, and that penalty will last for the rest of your life. Part B covers doctors, imaging, blood work, ambulance, durable medical equipment, etc. Part D is a Medicare Drug Plan and covers medications. During your initial enrollment period it is especially important to understand your options! Medicare Supplements/Medigap Plans are NOT guaranteed issue; you may need to medically qualify. You can purchase a Medigap Plan during your 1st 6 months on Medicare Part B without medical underwriting. There are a lot of things you need to know. Again, work with an agent you can trust! Especially important: when you move you need to know your options. Can you keep the same plan? Do you need to make a change and what does that look like?

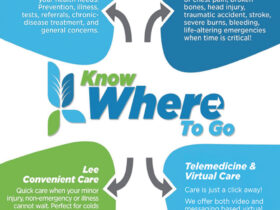

Logical Insurance Solutions is a SWFL Insurance Broker that works with most of the insurance carriers in your area, we are happy to help you through the maze. We offer Free Medicare Seminars, Personal Appointments & Virtual appointments. Please e-mail info@logicalinsurance.com to register or call 239-362-0855 for dates.

Medicare’s website is www.Medicare.gov.

Logical Insurance Solutions USA

www.Logicalinsurance.com

info@Logicalinsurance.com